The top 10% of the population controls about 90% of the nation's wealth; there are more than 40 million people living in poverty; there are about 15 million people unemployed and millions more underemployed; there are about fifty million medically uninsured individuals; and home foreclosures are expected to reach one million this year alone... No, I am not talking about Russia, I am not talking about Mexico, I am not even talking about Iran or China. I am talking about the wealthiest and the most powerful nation on earth, the United States of America. We live in an incredibly wealthy and powerful nation where tens of millions of people today live in squalor. With all the financial assets under its control, why is the United States more-and-more beginning to resemble a third world nation? Something is just not right here. What is the problem?

The fundamental problem with the United States today is Washington's pursuit of global dominance and the elite band of financial/political oligarchs that runs the system of government in America via their front offices - Democrat and Republican parties. The elite's gluttonous pursuit of empire in far away places like Korea, Georgia, Kosovo, Saudi Arabia, Iraq, Afghanistan and Pakistan has turned the American dream into a nightmare for Americans on Main Street.

Observing this nation's mainstream press's coverage of the economic downturn during the last year of George Bush's disastrous reign as president, one would have easily gotten the impression that the sky was falling; and, in a sense, it was. Bush's Neoconservative administration had squandered trillions of dollars, they had gotten the nation embroiled in failed military campaigns overseas and they had driven the United States to the very brink of collapse. The Bush administration had miserably failed to lead the empire. As a result, the sophisticated propaganda apparatus of the nation's political/financial elite began working in full gear. Media pundits were sparing no effort in emphasizing bad news in America and President Bush was more-or-less being portrayed to the public was a bloodthirsty idiot.

All this because the new boy on the block, Barak Obama, had to be promoted now to give the empire a new impetus, a revitalizing boost. So, faced with incessant bad news about America's economic health and a Republican presidential ticket that curiously featured a senile warmonger and a brain-dead bimbo, the people opted to settle for Barak Obama, also known at the time as the "Black Knight".

With Obama finally placed into power, the controlled news press then began approaching America's economic woes very carefully. All of a sudden, with Obama's Wall Street friendly administration in power in Washington, the rhetoric about the economy had become very nuanced. Soon, forecasts on the economy began getting very hopeful, even very positive at times. Negative news that happened to force itself into public awareness periodically was either ignored or whitewashed. Moreover, in an attempt to instill life into the lifeless economy, they continued printing hundreds of billions of dollars - out of thin air. In short, we were constantly being told Barak Obama was now in power and all was going to be well...

To begin with, printing money to cure fundamental economic illnesses is like taking morphine to cure cancer. Printing money is a temporary relief, it's not a cure. When its effect wears off, the problem, the illness is still there. Even after pumping hundreds of billions dollars of so-called stimulus money into the ailing economy, however, there has been little if any positive effect on the overall health of the economy.

The economy of the United States today is no better today than it was during Bush's reign. Despite the Fed's money printing fetish, despite the mainstream news media's best efforts to whitewash the serious economic problems that are continuing to plague this nation, the economic downturn in the United States has continued unabated. All that the Obama administration's financial experts have managed to do in their two years at the helm in Washington has been to basically delay the inevitable. And much to their dismay, recent bad economic indicators have left top news media executives no choice but to address the matter at hand. America's tens of millions of impoverished and well over ten million citizens without employment today have again made big headlines all across the nation (see relevant articles below).

In my opinion, the following is the fundamental issue at hand: The United States is the wealthiest nation on earth. In fact, the United States holds unprecedented wealth and power. Yet, the United States is also a nation that hosts perhaps the highest rate of impoverished citizens amongst developed nations of the western world. America is also a nation that hosts the highest numbers of uninsured citizens in the developed world. America is also a nation that performs very poorly in the education index in the developed world. America is also a nation that performs very poorly in the standard-of-living index in the developed world. America is also a nation that performs poorly in the corruption index in the developed world. Moreover, the population's tax burden in America has been gradually increasing all across the board as well.

When "socialist" Europeans pay high taxes, at least they get something in return - free education, free medical insurance, great employment benefits, excellent social services, funding for the arts... In stark contrast, American people's tax monies are simply used by the oligarchic system in the United States to wage wars overseas. In a sense, the American people are funding the unnecessary global wars being waged by Washington's political/financial elite. As I already mentioned, the fundamental problem with the United States today is its burning desire to maintain an empire - an empire that serves perhaps the top one percent of the population, at the cost of the remaining ninety-nine percent.

America's road to attaining an empire more-or-less began back in the early 1900s when Britain's global oligarchs convinced America's wannabe global oligarchs that it was is in Washington's interest to take the baton of empire from British hands. With the British finally free of their empire's global burdens, Washington was quickly and suddenly thrusted unto the global scene. It has more-or-less snowballed from there. First World War, Second World War, Cold War, Soviet collapse... While maintaining a global empire proved immensely profitable for a while, the chickens, as they say, are now finally coming home to roost. Hundreds of billions of dollars are now being wasted maintaining over a thousand American military facilities all across the world. Hundreds of billions of dollars are being wasted pursuing "Islamic terrorists" that are supposedly seeking to destroy America. Hundreds of billions of dollars are being wasted chasing phantoms in Iraq and Afghanistan. Hundreds of billions of dollars are being wasted in various efforts to undermine nations like Russia, Iran and Venezuela. Hundreds of billions of dollars are being wasted propping up tyrannical regimes around the world. In short, trillions of dollars are being wasted in efforts to colonize the world - as millions in America go homeless and unemployed.

A logical question no one seems to be asking: why don't we see millions of Americans protesting in the streets against this corrupt system of governance, one that is oppressing the American people as well as terrorizing the global community with its destructive and corrosive policies? Why aren't Americans, like the Armenians, or the Greeks, or the French, protesting/rioting in various hard hit areas of the United States and demanding real change? Why do Americans continue believing in the Democrat-Republican two ring circus every four years? Why are Americans still complacent? Where are the "opposition" parties in America? Where is the equivalent of America's "Radio Liberty" to constantly search for Washington's dirty laundry to show on American airwaves? Where are the equivalent of America's "Rights Groups" seeking to protect the human rights of the citizenry here? Where is the indignation, where is the anger? Where are the calls for real change?

Americans have been getting brutally raped by those who supposedly represents them in Washington - yet they continue patriotically waving American flags (made in China of course) every chance they get. Simply amazing. This almost suicidal complacency of Americans is perhaps explained by the fluoride in the drinking water...

I have a novel idea for America's oligarchs: allow this nation to be the "republic" it was meant to be and stop the destructive pursuit of empire. And there's more advice. Bring back the hundreds of thousand of troops stationed overseas and place them in special social brigades to fix the country's dilapidated infrastructure. Shutdown the hundreds of military bases abound the world and use the immense sums of money we are currently wasting on them to modernize America's aging infrastructure. Stop wasting hundreds of billions of dollars on global military offensives and start providing the citizenry in America with free medical care and free education instead. Stop wasting money bribing corrupt regimes around the world and place the money into scientific research in America instead. Start investing in new technologies in America. Start investing in the development of alternative/renewable energy in America. Start rebuilding America's decimated industrial sector...

There is a lot that can be done to invest in the future of the United States but nothing is being done and trillions of dollars are being wasted and looted by its financial/political elite. Taking a close look at who and what runs the political/economic machine of America's vast empire, I do not think that any of the aforementioned pro-American measures will be implemented. Why is it that when officials in Germany, France or Britain look at their troubled economies they all realize that they have to tighten their belts by implementing austerity measures, yet when Washingtonian officials look at their ailing economy all they can think about is firing up their printing presses instead? American officials desperately need to drop the empire habit and begin implementing austerity measures however painful they may be today - so that its children aren't forced to suffer an economic calamity in the future. Investing in the future of a nation requires a lot of money, a lot of hard work, selflessness and patience. Historically, war making has been the easiest way for any governing elite to make fast-easy money. This ancient formula has not changed today, especially in Washington. There has yet to come a generation in America that has not gone to war overseas. As with all other empires that have come before it, the oligarchs manning the control room in Washington will eventually drive this once great nation into ruin. I conclude by posting the following comment:

"If Americans could just understand how much wealth is being withheld from us, we would have a massive uprising and the Economic Elite would be swept away, into the history books alongside the evil despots of the past" - David DeGraw

Arevordi

***

October, 2010

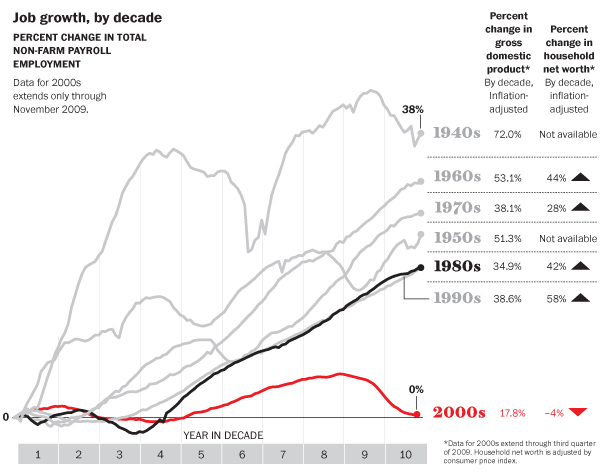

This may not be your grandfather's Great Depression, but many aspects of today's situation would remind him of the 1930s. If the recession that officially ended a year ago feels uncomfortably surreal to you yet familiar to him, it's probably because the recovery went missing. During the average recovery since World War II, gross domestic product (GDP) surpassed the pre-recession high five quarters after the recession began. It has never taken longer than seven quarters. Yet today, after 11 quarters, GDP is still below what it was in the fourth quarter of 2007. The economy is growing at only about a third of the rate of previous postwar recoveries from major recessions. Obama administration officials such as Treasury Secretary Tim Geithner have argued that without their policies the economy would be worse, and we might have fallen "off a cliff." While this assertion cannot be tested, we can compare the recent experience of other countries to our own.

The chart nearby compares total 2007 employment levels in the United States, the United Kingdom, the 16 euro zone countries, the G-7 countries and all OECD (Organization for Economic Cooperation and Development) countries with those of the second quarter of 2010. There are 4.6% fewer people employed in the U.S. today than at the start of the recession. Euro zone countries have lost 1.7% of their jobs. Total employment in the U.K. is down 0.6%, G-7 average employment is down 2.4%, and OECD employment has fallen 1.9%. This simple comparison suggests two things. First, that American economic policy has been less effective in increasing employment than the policies of other developed nations. Second, that if there was a cliff out there, no country fell off. Those that suffered the most were the most profligate, such as Greece, and their problems can't be blamed on the financial crisis. While the most recent quarterly growth figures are just a snapshot in time, it is hardly encouraging that economic growth in the U.S. (1.7%) is lower than in the euro zone (4%), U.K. (4.8%), G-7 (2.8%) and OECD (2%).

Most striking about these comparisons is their similarity to the U.S. experience in the Great Depression. Using data from the League of Nations' World Economic Survey, we can look at unemployment in developed nations between 1929 and the end of 1938. Ten years after the stock market crash, total employment in the U.S. was still almost 20% below the pre-Depression level. The decline in France was similar. But in the U.K. and Italy, total employment was up 10% and 12%, respectively. Industrial production on average in the six most developed countries was almost 16% above their 1929 levels by the end of 1938, but industrial production had declined by 20% in the U.S. Today's lagging growth and persistent high unemployment are reminiscent of the 1930s, perhaps because in no other period of American history has our government followed policies as similar to those of the Great Depression era. Federal debt by the end of 1938 was almost 150% above the 1929 level. Federal spending grew by 77% from 1932 to 1934 as the New Deal was implemented—unprecedented for peacetime.

Still the economy did not take off. Winston Churchill gave a contemporary evaluation of the Roosevelt policy by observing, in the April 24, 1935, Daily Mail, "Nearly two thousand millions Sterling have been poured out to prime the pump of prosperity; but prosperity has not begun to flow." The top individual income tax rate rose from 24% to 63% to 79% during the Hoover and Roosevelt administrations. Corporate rates were increased to 15% from 11%, and when private businesses did not invest, Congress imposed a 27% undistributed profits tax. In 1929, the U.S. government collected $1.1 billion in total income taxes; by 1935 collections had fallen to $527 million. In 1929, individual income taxes accounted for 38% of government revenues, corporate taxes accounted for 43%, and excise taxes for 19%. By 1939, individual income taxes made up only 26% of federal revenues, corporate income taxes made up 29%, and excise taxes made up 45%. When Treasury Secretary Henry Morgenthau suggested to President Roosevelt that the administration cut income tax rates in 1939, Roosevelt, apparently concerned about the possible effect of deficit-financed tax cuts on interest rates, asked, "You are willing to pay usury in order to get recovery?" Morgenthau said that he responded, "Yes sir." The president disagreed.

The Roosevelt administration also conducted a seven-year populist tirade against private business, which FDR denounced as the province of "economic royalists" and "malefactors of great wealth." The war on business and wealth was so traumatic that the League of Nations' 1939 World Economic Survey attributed part of the poor U.S. economic performance to it: "The relations between the leaders of business and the Administration were uneasy, and this uneasiness accentuated the unwillingness of private enterprise to embark on further projects of capital expenditure which might have helped to sustain the economy." Churchill, who was generally guarded when criticizing New Deal policies, could not hold back. "The disposition to hunt down rich men as if they were noxious beasts," he noted in "Great Contemporaries" (1939), is "a very attractive sport." But "confidence is shaken and enterprise chilled, and the unemployed queue up at the soup kitchens or march out to the public works with ever growing expense to the taxpayer and nothing more appetizing to take home to their families than the leg or wing of what was once a millionaire. . . It is indispensable to the wealth of nations and to the wage and life standards of labour, that capital and credit should be honoured and cherished partners in the economic system. . . ."

The regulatory burden exploded during the Roosevelt administration, not just through the creation of new government agencies but through an extraordinary barrage of executive orders—more than all subsequent presidents through Bill Clinton combined. Then, as now, uncertainty reigned. As the textile innovator Lammot du Pont complained in 1937, "Uncertainty rules the tax situation, the labor situation, the monetary situation, and practically every legal condition under which industry must operate." Henry Morgenthau summarized the policy failure to the House Ways and Means Committee in April 1939: "Now, gentleman, we have tried spending money. We are spending more than we have ever spent before and it does not work . . . I say after eight years of this administration we have just as much unemployment as when we started . . . and an enormous debt, to boot."

Despite the striking similarities between then and now, there is one major difference: Roosevelt's policies remained popular even as the economy faltered. The magnitude of the Depression, with its lack of stabilizers and safety nets, traumatized Americans and undermined their confidence in the economic system. This induced voters, as historians would later do, to judge Roosevelt not on his results but on his intentions. Today, however, the Obama program appears to be failing politically as well as in the marketplace. The trauma of the financial crisis did not approach that of the Great Depression, and Americans do not appear to have lost faith in our economic system or come to see government as the savior. While progressivism gave the New Deal its intellectual foundations, history today is driven by the freedom tide that produced our economic revival in the 1980s and '90s and still drives economic liberalization in China and India.

Finally, we should not underestimate that this administration faces stronger and more united congressional opposition than FDR ever faced. The House and Senate Republican leadership has far surpassed all expectations of a minority party. Mitch McConnell of Kentucky and John Boehner of Ohio have led a loyal opposition that, through its unity, has exposed the radical underbelly of the Obama program. Young guns like Paul Ryan of Wisconsin and Jeb Hensarling of Texas have provided vision and energy. FDR rode the tide of history while President Obama strives mightily against it. The progressive vision that resonated in the 1930s foundered on the hard experience of the 20th century, and it has no broad appeal in the 21st. The recovery from the Great Depression did not occur until World War II was underway, but it appears, as of today, that voters will bring the latest experiment in American collectivism to an end on Nov. 2. A real economic recovery won't be far behind.

Mr. Gramm is a former U.S. senator from Texas and former professor of economics at Texas A&M University.

Source: http://online.wsj.com/article/SB10001424052748704116004575522351201224286.html?KEYWORDS=depressionRecession Raises Poverty Rate to a 15-Year High

The percentage of Americans struggling below the poverty line in 2009 was the highest it has been in 15 years, the Census Bureau reported Thursday, and interviews with poverty experts and aid groups said the increase appeared to be continuing this year. With the country in its worst economic crisis since the Great Depression, four million additional Americans found themselves in poverty in 2009, with the total reaching 44 million, or one in seven residents. Millions more were surviving only because of expanded unemployment insurance and other assistance. And the numbers could have climbed higher: One way embattled Americans have gotten by is sharing homes with siblings, parents or even nonrelatives, sometimes resulting in overused couches and frayed nerves but holding down the rise in the national poverty rate, according to the report.

The share of residents in poverty climbed to 14.3 percent in 2009, the highest level recorded since 1994. The rise was steepest for children, with one in five affected, the bureau said. The report provides the most detailed picture yet of the impact of the recession and unemployment on incomes, especially at the bottom of the scale. It also indicated that the temporary increases in aid provided in last year’s stimulus bill eased the burdens on millions of families. For a single adult in 2009, the poverty line was $10,830 in pretax cash income; for a family of four, $22,050. Given the depth of the recession, some economists had expected an even larger jump in the poor. “A lot of people would have been worse off if they didn’t have someone to move in with,” said Timothy M. Smeeding, director of the Institute for Research on Poverty at the University of Wisconsin.

Dr. Smeeding said that in a typical case, a struggling family, like a mother and children who would be in poverty on their own, stays with more prosperous parents or other relatives. The Census study found an 11.6 percent increase in the number of such multifamily households over the last two years. Included in that number was James Davis, 22, of Chicago, who lost his job as a package handler for Fed Ex in February 2009. As he ran out of money, he and his 2-year-old daughter moved in with his mother about a year ago, avoiding destitution while he searched for work. “I couldn’t afford rent,” he said.

Danise Sanders, 31, and her three children have been sleeping in the living room of her mother and sister’s one-bedroom apartment in San Pablo, Calif., for the last month, with no end in sight. They doubled up after the bank foreclosed on her landlord, forcing her to move. “It’s getting harder,” said Ms. Sanders, who makes a low income as a mail clerk. “We’re all pitching in for rent and bills.” There are strong signs that the high poverty numbers have continued into 2010 and are probably still rising, some experts said, as the recovery sputters and unemployment remains near 10 percent. “Historically, it takes time for poverty to recover after unemployment starts to go down,” said LaDonna Pavetti, a welfare expert at the Center on Budget and Policy Priorities, a liberal-leaning research group in Washington.

Dr. Smeeding said it seemed almost certain that poverty would further rise this year. He noted that the increase in unemployment and poverty had been concentrated among young adults without college educations and their children, and that these people remained at the end of the line in their search for work. One indirect sign of continuing hardship is the rise in food stamp recipients, who now include nearly one in seven adults and an even greater share of the nation’s children. While other factors as well as declining incomes have driven the rise, by mid-2010 the number of recipients had reached 41.3 million, compared with 39 million at the beginning of the year.Food banks, too, report swelling demand.

“We’re seeing more younger people coming in that not only don’t have any food, but nowhere to stay,” said Marla Goodwin, director of Jeremiah’s Food Pantry in East St. Louis, Ill. The pantry was open one day a month when it opened in 2008 but expanded this year to five days a month. And Texas food banks said they distributed 14 percent more food in the second quarter of 2010 than in the same period last year. The Census report showed increases in poverty for whites, blacks and Hispanic Americans, with historic disparities continuing. The poverty rate for non-Hispanic whites was 9.4 percent, for blacks 25.8 percent and for Hispanics 25.3 percent. The rate for Asians was unchanged at 12.5 percent.

The median income of all households stayed roughly the same from 2008 to 2009. It had fallen sharply the year before, as the recession gained steam and remains well below the levels of the late 1990s — a sign of the stagnating prospects for the middle class. The decline in incomes in 2008 had been greater than expected, and when the two recession years are considered together, the decline since 2007 was 4.2 percent, said Lawrence Katz, an economist at Harvard. Gains achieved earlier in the decade were wiped out, and median family incomes in 2009 were 5 percent lower than in 1999. “This is the first time in memory that an entire decade has produced essentially no economic growth for the typical American household,” Mr. Katz said.

The number of United States residents without health insurance climbed to 51 million in 2009, from 46 million in 2008, the Census said. Their ranks are expected to shrink in coming years as the health care overhaul adopted by Congress in March begins to take effect. Government benefits like food stamps and tax credits, which can provide hundreds or even thousands of dollars in extra income, are not included in calculating whether a family’s income falls above or below the poverty line. But rises in the cost of housing, medical care or energy and the large regional differences in the cost of living are not taken into account either.

If food-stamp benefits and low-income tax credits were included as income, close to 8 million of those labeled as poor in the report would instead be just above the poverty line, the Census report estimated. At the same time, a person who starts a job and receives the earned income tax credit could have new work-related expenses like transportation and child care. Unemployment benefits, which are considered cash income and included in the calculations, helped keep 3 million families above the line last year, the report said, with temporary extensions and higher payments helping all the more.

The poverty line is a flawed measure, experts agree, but it remains the best consistent long-term gauge of need available, and its ups and downs reflect genuine trends. The federal government will issue an alternate calculation next year that will include important noncash and after-tax income and also account for regional differences in the cost of living. But it will continue to calculate the rate in the old way as well, in part because eligibility for many programs, from Medicaid to free school lunches, is linked to the longstanding poverty line.

Source: http://www.nytimes.com/2010/09/17/us/17poverty.html

Lost Decade for Family Income

The bureau's annual snapshot of American living standards also found that the fraction of Americans living in poverty rose sharply to 14.3% from 13.2% in 2008—the highest since 1994. Some 43.6 million Americans were living below the official poverty threshold, but the measure doesn't fully capture the panoply of government antipoverty measures. The inflation-adjusted income of the median household—smack in the middle of the populace—fell 4.8% between 2000 and 2009, even worse than the 1970s, when median income rose 1.9% despite high unemployment and inflation. Between 2007 and 2009, incomes fell 4.2%. "It's going to be a long, hard slog back to what most Americans think of as normalcy or prosperous times," said Nicholas Eberstadt, a political economist at the right-leaning American Enterprise Institute.

The data, released Thursday, underscore the extent to which U.S. households relied on government benefits—and each other—to weather the recession and how living standards at the middle of the middle class have stalled. The report comes as the economy is at the center of a vigorous debate over how government policy can best help the poor and unemployed. President Barack Obama, in a statement, said the report showed that because of stimulus spending, "millions of Americans were kept out of poverty last year." Republicans, meanwhile, saw the report in a different light. "By any objective standard, the stimulus failed to deliver on the promised results," said a spokesman for Congress Paul Ryan (R-Wis.). The median household income fell 0.7% to $49,777 in 2009, down 4.2% since 2007, when the recession started, the Census Bureau said.

The bureau said that the drop in income in the recent recession, so far, wasn't much different from those recorded in the early 1990s and early 2000s recessions, and was actually smaller than the 6% drop recorded in the deep recession of the early 1980s. But there is a difference this time: In the prior three recessions, incomes fell after years of upswing, then resumed growing once the downturn ended. The decline this time comes on top of a long period in which incomes stagnated even through the recovery of 2003 to 2007. The decline in incomes cuts across age, race and class, with some exceptions. Hispanics and Asians saw small increases in their median incomes.

The recession has been particularly hard on young workers and young families, in part because they aren't eligible for as many government benefits as older workers. Younger workers have a harder time qualifying for unemployment benefits because they have a shorter work history. That has prompted many young adults to move in with family, or put off leaving home in the first place. The number of 25-to-34-year-olds living with their parents rose 8.4% to 5.5 million in 2010 from 2008. Within that age group, 42.8% fell below the poverty threshold—$11,161 for an individual. The report also showed a steep rise in child poverty, to 23.8% for kids under six in 2009, compared to 21.3% a year earlier.

The Census snapshot indicated that the gap between the best-off and worst-off Americans widened a bit more in 2009, a long-standing trend, but not by much. The top fifth of households accounted for 50.3% of all pre-tax income; the bottom two-fifths got 12%. In 1999, the top fifth claimed 49.4% and the bottom got 12.5% of the income. Some Americans weathered the slump the old-fashioned way—by merging households. The Census Bureau noted a big jump in the number of individuals and families doubling up. The number of multifamily households jumped 11.6% from 2008 to 2010, while the total number of households rose 0.6%.

Carol Hanlon, 58, is struggling with the basics. She makes about $15,000 a year at her job packing boxes at a printing company. Her wages and hours were cut this year, and she is now supporting her unemployed husband, who is without health insurance because her company stopped offering health insurance for spouses. "I got double whammied," says Ms. Hanlon, who lives in Easton, Penn., and is receiving food stamps and heating-oil assistance. The oldest Americans endured last year better than their younger counterparts. Those 65 and above saw a substantial increase in real median income, up 5.8% for the group. That is largely because the fortunes of older workers are tied more to Social Security checks than the job market. Without Social Security income, the report showed, some 14 million people eligible for benefits would have fallen below the poverty line.

The threshold for poverty in the U.S. in 2009 was a family of four earning $21,756. But this only takes into account monetary income, while omitting the many benefits that now form the backbone of the government efforts to lift the poor. Such programs include subsidized housing and the Earned Income Tax Credit. The poverty rate "misses most of the programs that have been added or expanded in the last 20 years to reduce poverty," says Bruce Meyer, an economist at the University of Chicago. For instance, the government estimates if the food stamp program was counted, it would have lifted 3.6 million people above the poverty threshold last year.

Source: http://online.wsj.com/article/SB10001424052748703440604575495670714069694.html

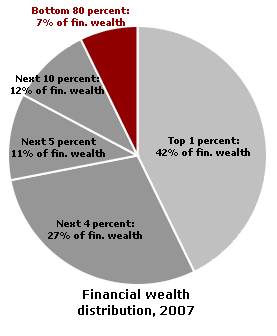

Many Americans are not buying the recent stock market rally. This is being reflected in multiple polls showing negative attitudes towards the economy and Wall Street. Wall Street is so disconnected from the average American that they fail to see the 27 million unemployed and underemployed Americans that now have a harder time believing the gospel of financial engineering prosperity. Americans have a reason to be dubious regarding the recovery because jobs are the main push for most Americans. A recent study shows that over 70 percent of Americans derive their monthly income from an actual W-2 job. In other words, working is the prime mover and source of their income. Yet the financial elite have very little understanding of this concept. Why? 42 percent of financial wealth is controlled by the top 1 percent. We would need to go back to the Great Depression to see such lopsided data.

Many Americans are still struggling at the depths of this recession. We have 37 million Americans on food stamps and many wait until midnight of the last day of the month so checks can clear to buy food at Wal-Mart. Do you think these people are starring at the stock market? The overall data is much worse:

If we break the data down further we will find that 93 percent of all financial wealth is controlled by the top 10 percent of the country. That is why these people are cheering their one cent share increase while layoffs keep on improving the bottom line. But what bottom line are we talking about here? The Wall Street crowd would like you to believe that all is now good that the stock market has rallied 60+ percent. Of course they are happy because they control most of this wealth. Yet the typical American still has negative views on the economy because they actually have to work to earn a living:

The above daily poll asks Americans about their view on the health of the economy. Only 13 percent believe the economy is good or excellent. Funny how that correlates with the top 10 percent who control 93 percent of wealth. Many Americans were sold the illusion of the bubble. They were sold on the idea that their homes were worth so much more than they really were. And many used this phony wealth effect to go out and spend beyond their means. They started spending as if they were part of this elite 10 percent crowd. But once the tide rolled out, it was clear they were not. And the horribly built bailouts demonstrate who is controlling our political system. This was not the rule of a capitalist system but a corporate run government.

Just think about the bailouts and which companies were saved. We ended up bailing out the worst performing and troubled companies thus keeping alive companies that should have completely failed. Did we bail out Google? Proctor and Gamble? Of course not. These companies actually produce something that people want. Banks and especially the Wall Street kind merely keep that 42 percent happy by making sure their stock values stay high so they can keep on making money while the average Americans is sold up the river. Yet many were brought into the easy money fold by going into massive amounts of debt. And who has most of the debt? That is right, the average American:

The bottom 90 percent have been saddled with 73 percent of all debt. In other words much of their so-called wealth is connected to debt. Debt is slavery for many especially with egregious credit card companies taking people out with absurd credit card tricks and scams. Yet the corporate propaganda machine is strong and mighty. Have you ever received an inheritance? A large one? Probably not because only 1.6% of all Americans receive an inheritance larger than $100,000. If this is the case, why in the world do politicians worry so much about the tax impacts of this? Because they want to keep the corporatocracy alive and well so their spawn can get a piece of their pie. They give the illusion to average Americans that if you only work hard enough you too can join this elusive club of cronies. The data shows otherwise. But if we start looking at investment assets, the true wealth in the country, we start realizing why Wall Street is all giddy about the recent stock market government induced rally:

The number of uninsured Americans rose by 4.4 million to 50.7 million last year, the largest annual jump since the government began collecting comparable data in 1987, according to the Census Bureau. The figures released Thursday provide fresh evidence about the negative effects of the economic downturn on health-insurance coverage. And they could become a political talking point in the debate over the health-care overhaul in the run-up to the midterm elections.

The percentage of Americans covered by private insurance last year, 63.9%, was the lowest since 1987, while the percentage of people covered by government programs, 30.6%, was the highest. Overall, the number of Americans with some form of health coverage dropped last year for the first time since 1987, to 253.6 million in 2009 from 255.1 million in 2008. "It's just a very substantial increase in the number of uninsured in one year," said Diane Rowland, executive vice president of the Kaiser Family Foundation, a nonprofit research group. "It shows that health-insurance stability is very fragile for most families." The numbers could be controversial. The 50.7 million uninsured Americans—16.7% of the population—likely include some who could afford coverage but choose not to buy it, or people who could qualify for government assistance but haven't done so. The Employment Policies Institute, a right-leaning research organization, said the numbers don't present a complete picture.

The shift from private to public coverage became more pronounced last year as the unemployment rate hit 9.7% in August 2009, up from 6.1% a year earlier, according to the Bureau of Labor Statistics. The number of Americans with employer-sponsored coverage dropped by 6.6 million, to 169.7 million last year from 176.3 million in 2008—the largest one-time drop since 1987, according to the Census Bureau. The total number of Americans with private insurance fell to 194.5 million from 201 million. The drops happened even as the government helped to subsidize Cobra coverage, the federal program that allows people who have lost their jobs to pay for continued coverage.

Major health plans reported steep declines in enrollment last year. Karen Ignagni, president of America's Health Insurance Plans, an industry trade organization, said the numbers echo what she has heard from her members, who have reported more healthy people and small businesses forgoing coverage. "Two factors are combining into a crisis: The slowdown in the economy and rising costs," she said. Meanwhile, more Americans turned to the government for health insurance. The number of Americans covered by Medicaid, the health program for the poor, increased to 47.8 million in 2009 from 42.6 million in 2008, and is now the largest percentage of the population on the program since 1987, the Census Bureau said. The total number of people covered by government programs rose to 93.2 million last year, up from 87.4 million in 2008.

The drop in the total number of covered Americans suggests people lost their employer-based benefits at a faster rate than government programs could pick them up. Between 2007 and 2008, even though employer-based coverage eroded, the total number of Americans with health coverage continued to rise as more people found coverage through government programs. But last year, the drop in employer-based coverage became more pronounced, the Census data show. Ron Pollack, executive director of Families USA, a left-leaning health-care advocacy group, said Medicaid couldn't absorb all the people who lost their jobs because some don't meet the eligibility requirements. "If it were not for these programs, the portion of the population that is uninsured would have been much higher," he said.

One bright spot in the data was the number of children covered. The number of uninsured children rose only slightly, to 7.5 million last year from 7.3 million in 2008. Democrats pointed to the new findings to shore up support for their health-care overhaul, which was passed in March. Rep. Pete Stark (D., Calif.) said, "The health-reform law will make a difference for tens of millions of people without insurance who will finally be able to afford quality health coverage. Republicans who want to repeal health reform have a message for them—you're on your own." Former House Speaker Newt Gingrich, a Republican, said both parties agreed that the 50 million number was unacceptable, though Republicans believe the health overhaul isn't the right answer and want to repeal it. "You want to get every American inside the health system," Mr. Gingrich said. "This country is not going to accept one in six without health insurance."

Source: http://online.wsj.com/article/SB10001424052748704394704575496093363948142.html

No comments:

Post a Comment